In the Carolan window

DAX 30 index analysis – Carolan’s window

As mentioned in the previous DAX 30 article, October and November are the last monthly Carolan window this year. The last week of November is ahead of us – can you expect a change in trend? We will see, however, please remember that today quite a strong Carolan window closed on the day of 22 – 23/11. What will happen tomorrow? According to historical data, there was always a fairly significant change in the price of the index after the last day of the window. Additionally, on November 26, 19, the new moon falls, so it is located near the Carolan’s window.

DAX 30 index analysis – lunar calendar

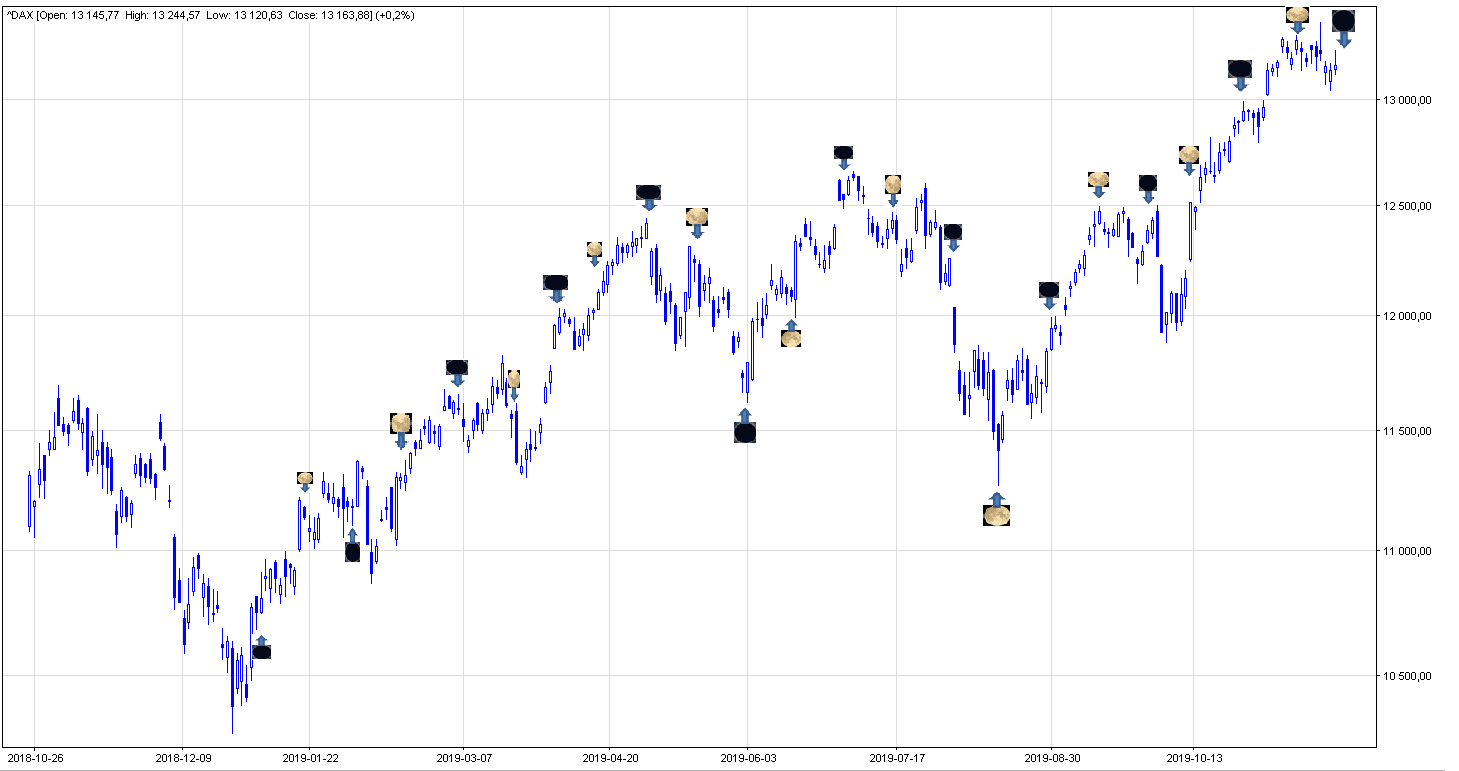

Figure 1 presents the DAX 30 daily intake with moon phase and full moon days marked. It is worth noting that the market significantly correlates with moon phases. Many times there were significant trend changes near the new moon or fully. And so, for example, the last rising wave started on the full moon (15/08/2019) lasted the best, until 12/11/2019, which was 4 times the repeatability of the full moon cycle. Can the lunar calendar and periodicity be random? Rather not and C. Carolan wrote about such market behavior. We can never be sure which, in turn, the cyclical nature of the moon phase will bring about a significant change in the market, but we can always estimate such a risk using statistical or technical analysis tools.

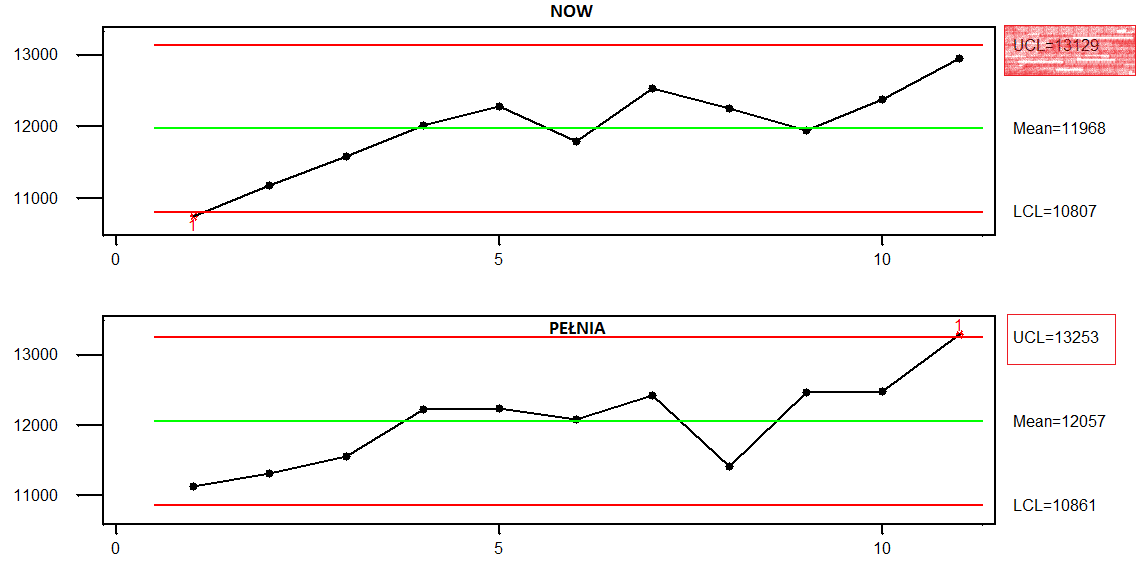

And so, Figure 2 presents the DAX 30 index values for the lunar calendar. Based on the data set of DAX 30 index values achieved on a given day of the moon phase (new moon, full moon), the range of support and resistance of the DAX 30 index was determined. As for the full moon – the last full moon closed practically at resistance in the region of 13253 points. Therefore, it can be seen that the next value of the DAX 30 index on full day will be key to maintaining the current upward trend. The same conclusions can be drawn in relation to the new moon trend. In just two days, the next new moon, if the DAX 30 value on the new moon will be less than 13129 points, this will show respect for resistance. Thus, the market should break the trend and start a downward trend.

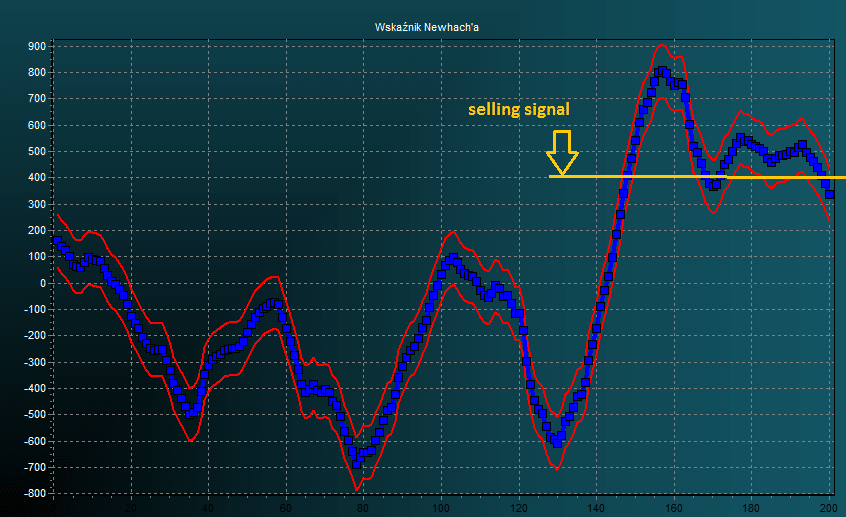

DAX 30 index analysis – indicator Newhach’a

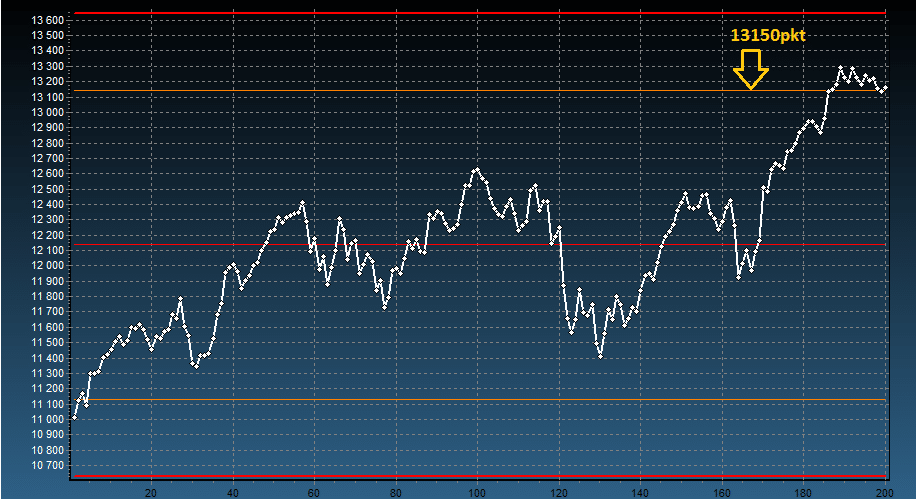

Figure 3 presents the newhach index for the DAX 30 German stock exchange index. Interestingly, despite recent slight increases in the DAX 30, the Newhach index has already generated a sales signal. Additionally, if you look at the system of statistical analysis – the course is currently struggling to maintain the level of 13150. Closing the DAX 30 below this value should give a signal to the bulls to retreat. The end of the month ahead of us, which should bring a decision. Both Carolan’s indications, signals from the lunar calendar and technical indicators tell us further movements of world stock exchanges including the DAX 30.