Carolan’s window theory – spiral calendar part 5.

Basically </ span> </ h5>

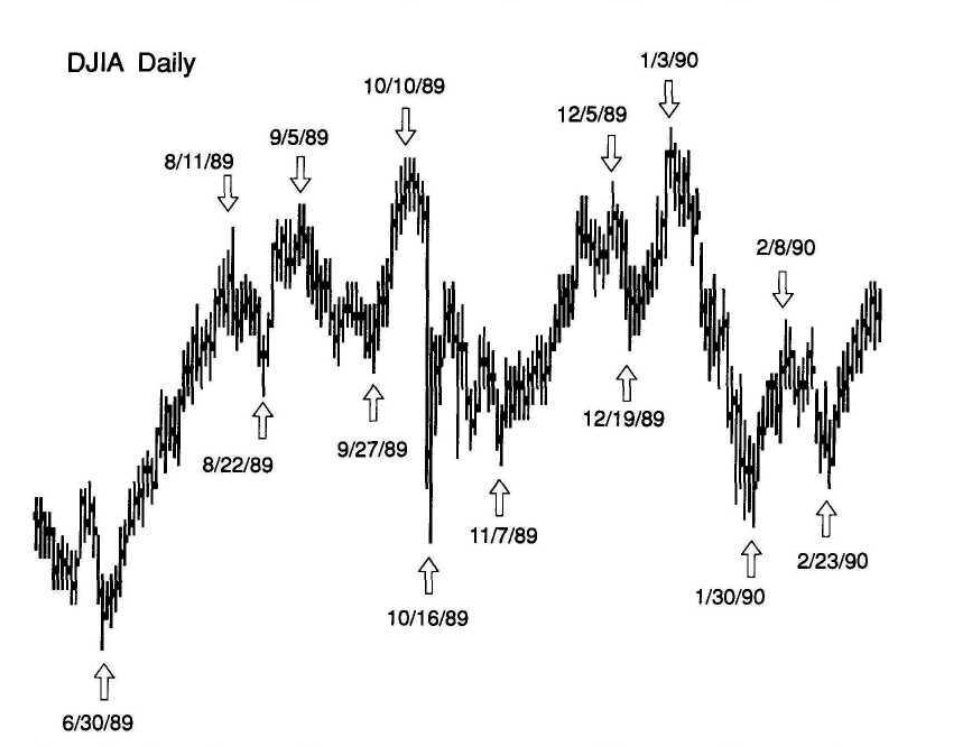

the method consists in determining future turning points of a given exchange instrument by means of a spiral calendar and significant turning points from the past. First of all, the main turning points of the market should be put on the chart – fig.1. (an example of the DJIA index of the American stock market from the 90s).

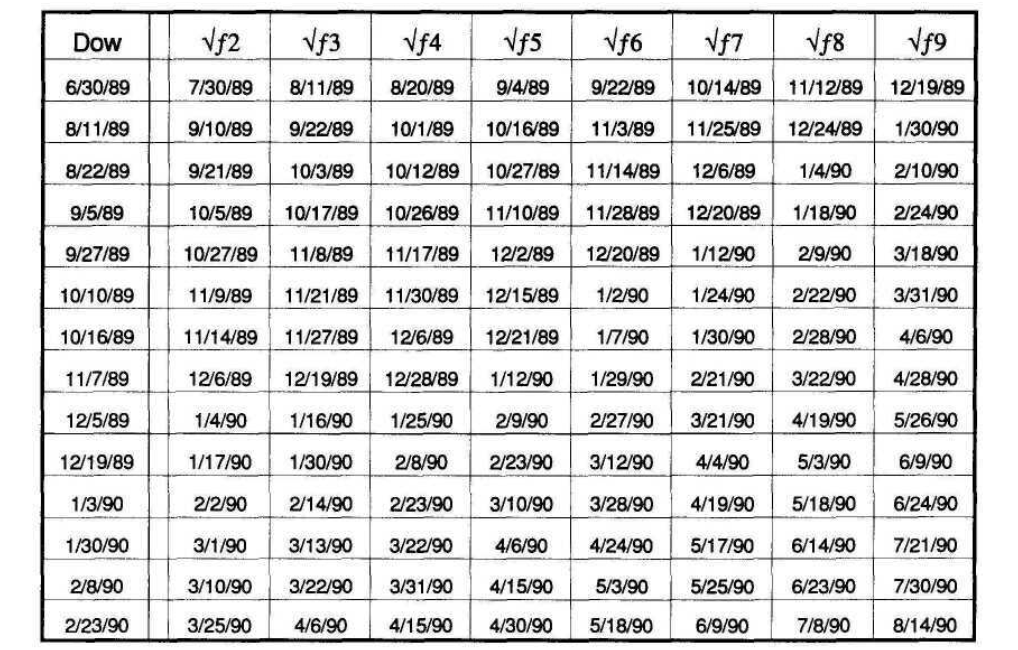

After determining the key dates, we create a table (No. 1) in which we place in turn:

- order of dates for turning points – in rows,

- while in columns, we enter dates calculated on the basis of a spiral calendar, ie f2, f3, f4, etc …

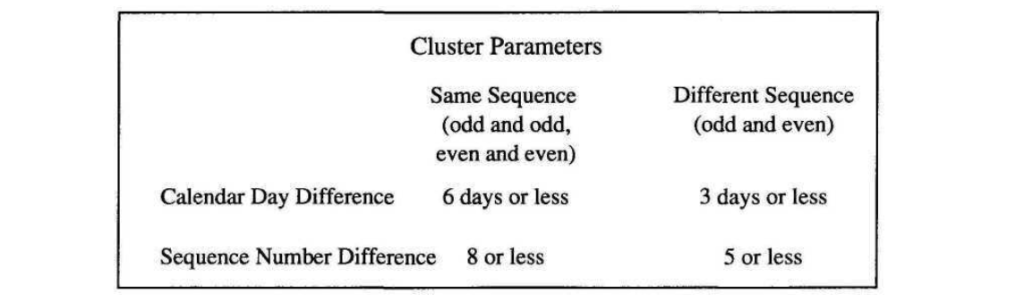

A prerequisite for two or more target days to become Carolan’s window is that they meet the condition of the so-called clusters of dates (cluster parameters – Fig.2.).

A cluster of dates is a collection of at least two closely related dates. A spiral calendar consists of two substrings: odd indexes and even indexes. Forecasts with the highest quality forecast are created when the dates obtained belong to the same substring. Another issue is the closeness of yourself to the dates obtained. According to C. Carolan, the forecasted dates are considered to be close to each other if they are generated by units of the same sequence, and the difference between them is no more than six calendar days. In the case of clusters of dates belonging to different strings, the quality of the forecast is worse. In order to improve its credibility, the criteria applied in this case are tightened – the difference between dates belonging to two substrings may not exceed three calendar days.

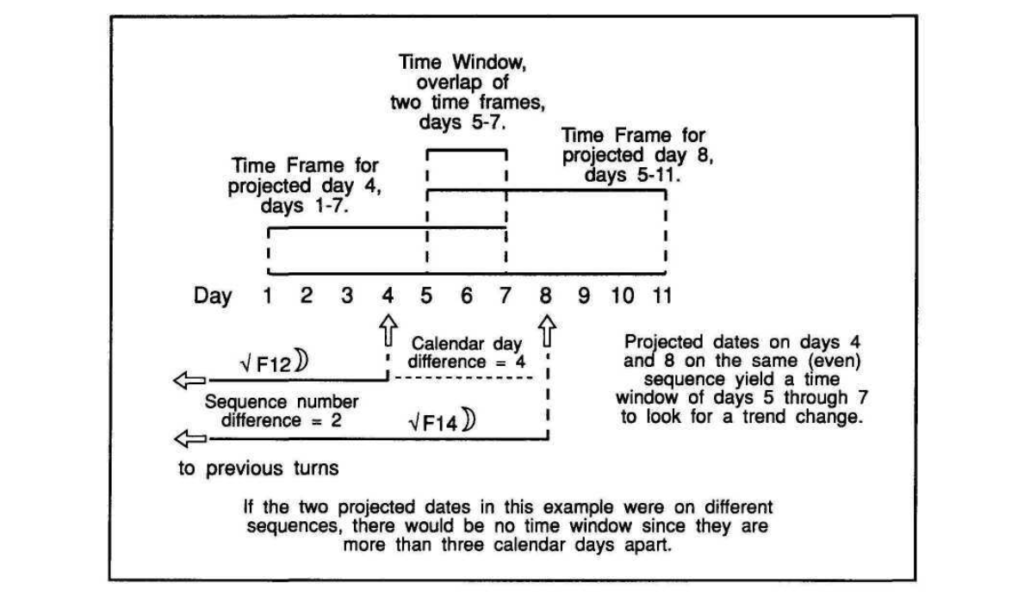

Each date obtained in the aggregate forms a time frame (Fig. 3), within which the turning point of the market, if it occurs, is considered to be precise. Turning points usually occur in the center of the window, although in fact left and right-side translations are also encountered.

Carolan assumes that the turning point should occur from 3 days before to 3 days after the target date. In this way, each date is associated with a seven-day frame, ie date +/- 3 days: (Date -3; Date +3).

The time frame is created by a time window, which is a part of the overlapping time frames arising from two or more dates of a given cluster. The turning point of the market always occurs not more than 3 days from each of the forecasted dates. The most relevant changes in the market trend are obtained when the clusters of dates occur during the full moon or the new moon.