Where we are at euro/usd?

Thats the authorial approach for market analysis.

I hope you enjoyed it. Its easy to understand and implementing it at your investing.

Let’s make analysis based on daily quotations.

Its taken last 400 days for euro/usd bahaviour. Let’s take a look for a data:

photo1. Euro/usd last 400 days - global view (newhach's graph)

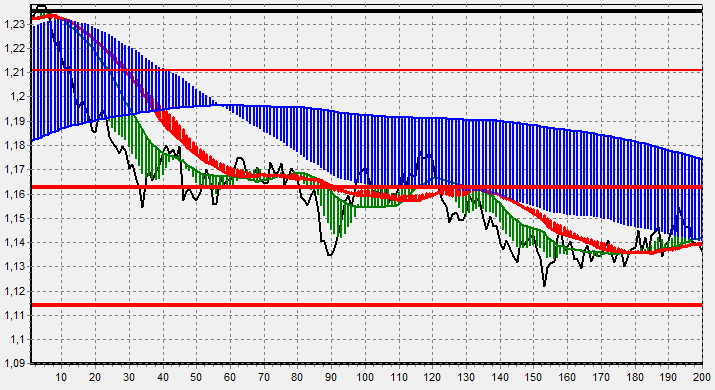

photo2: Graphical ilustration of Euro/Usd (last 200 days) ( newhach's interpretation)

Whats of interpretation of it?

1. blue area – type of global market trend (decreasing: arms directed down; growing up: arms directed up)

2. red line (red river) – the signal line

3. green line – adjuvant line

4. red border horizontal lines – support & resistance lines

5. black line – actual rate of euro/usd

How to interpret this:

- red river line keeps under the blue armes directed down: bears are on the market in the long period;

- red river line keeps over the blue armes directed up: its the bulls market in the long period;

- green line keeps under the red river line : bears are on the market in the short period;

- green line keeps over the red river line: its the bulls market in the short period;

where we are at euro/usd?

- bears are on the market now: red river is under the blue arms;

- actual euro/usd rate to rebound the resistance point: red river line and blue lines are almost touching each other (bear market);

- the nearest support place is 1.115

- be aware that the variability of actual rate will speed up in next week (bears are coming ) – be prepared.

in next post you will get:

- the hints for gold behaviour;